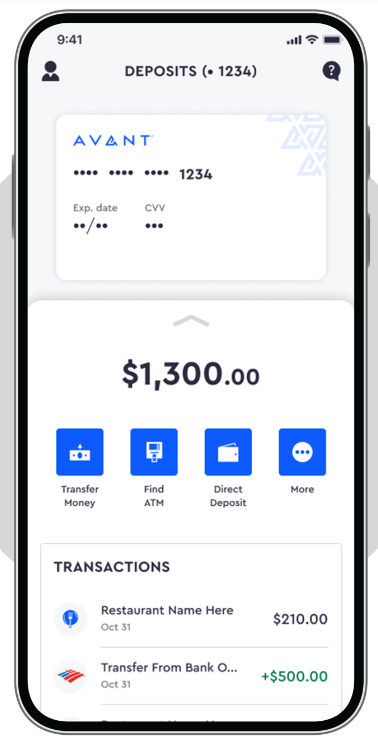

avant bank credit card

In this Avant credit card review, we will talk about whether this card is a excellent fit for those with a limited credit rating. Although the AvantCard does not affect your credit rating when you apply, it is an unsafe product that does have a tiny credit limit The Avant Personal Loan 2022, on the other hand, does not call for a credit history at all. The consumer evaluations and also contrast chart below must be of help for those that are taking into consideration getting this personal loan.

The Avant credit card is a solid option for a credit-building individual with reasonable to typical credit score. The annual fee is affordable and also the credit limit is a suitable beginning point. The Avant card likewise permits you to prequalify without a hard pull on your credit rating. As long as you more than the age of eighteen, this kind of credit card is an excellent alternative for establishing a solid credit history. The Avant credit card review likewise highlights the advantages and also negative aspects of this credit card.

avant credit card login