Exploring Gold Price Trends for Beginners

Beginners can discover gold price trends with this comprehensive guide. During durations of financial shift gold costs tend to attract intense rate of interest. Knowledge of gold price trends enables capitalists to make calculated choices in their gold financial investments. The effect of globally occasions and transformations on the value of gold may be something you intend to recognize much better. The characteristics of supply and demand along with economic stability and market speculation influence gold prices. Checking these elements can offer important benefits.

Exploring previous patterns can likewise use understandings. Checking out historic information discloses patterns that repeat over time. This information will enable you to anticipate future gold market activities.

Fundamentals of Gold Investing

Throughout history individuals have actually relied on gold as a financial investment due to its unique buildings and historical importance. This precious metal functions as security versus both inflation and changes in currency worths. Recognizing historic gold trends and its essential buildings notifies your financial investment approaches and selections.Historical Context of Gold as an Investment

Gold has actually been valued because old times. Throughout background individuals utilized gold as both a money and a depiction of riches. Money used to be backed by gold via a system referred to as the gold criterion. Although it has fallen out of use gold remains to shape modern perspectives about its worth.

During financial unpredictability, gold frequently gains popularity. When the world faces global tension or economic dilemmas financiers move their emphasis to gold since they see it as a trusted property. The rate of gold typically rises due to the fact that people see it as a trusted store of value. The historic appeal of gold brings in capitalists to include it in their modern portfolios. Gold offers security to investors which supplies normally do not have. A complete analysis of gold's historical performance assists anticipate its future market growths.

Properties of Gold

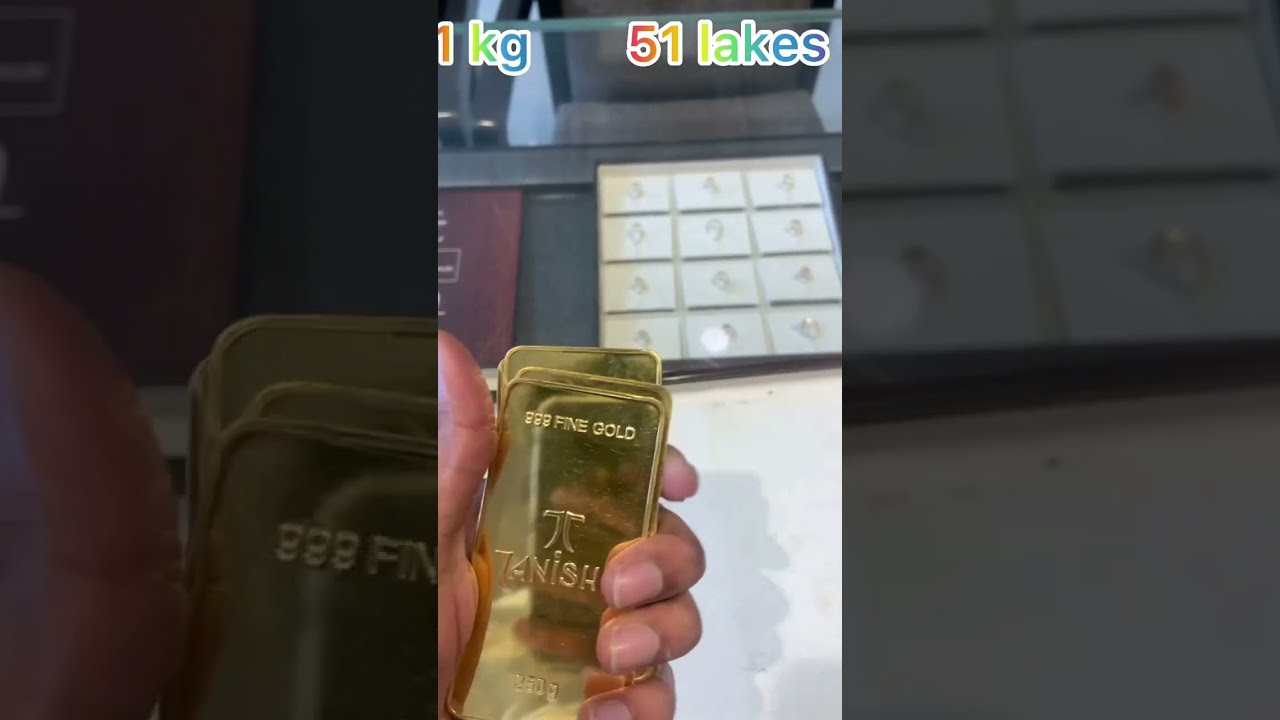

The shortage and sturdiness of gold make it extremely valued. Gold stays a lasting riches get due to the fact that it resists deterioration and staining. The limited annual mining production of gold adds to its high worth due to its shortage. Gold stays extremely fluid because worldwide markets make it easy to deal. Gold exists in multiple investment types consisting of coins and bars along with exchange-traded funds (ETFs). Several financial investment choices enable you to invest in gold with flexibility. Gold offers several industrial functions which encompass uses in electronics and jewelry. Gold's commercial and precious jewelry applications create a steady demand that keeps international interest in the steel. Analyzing these functions discusses why numerous individuals watch gold as a reputable investment option.Factors Affecting Gold Prices

Numerous vital elements produce significant variants in gold rates. Gold costs are influenced by economic indicators together with geopolitical occasions and supply and need dynamics. Knowledge of these factors permits you to comprehend the root causes of gold rate variations.Economic Indicators

Gold costs are greatly influenced by economic indicators which include interest rates, inflation degrees, and money stamina. An increase in rising cost of living decreases fiat money worth which leads individuals to acquire gold to safeguard their financial investments.Interest rates additionally influence gold prices. Gold comes to be a much more attractive investment when rates of interest drop due to the fact that it lacks the capacity to generate rate of interest or returns. Gold prices increase when the money worth weakens because gold comes to be costlier. Observing these indicators assists disclose prospective variations in gold's value.

Geopolitical Events

People often pick gold as a safe financial investment during geopolitical occasions that create uncertainty. Gold prices may change because of conflicts and political instability as well as governmental policy alterations. Financiers commonly transform to gold throughout tense periods since it protects its worth amidst crises. Gold's worth shifts when trade tensions or sanctions influence worldwide market problems. Analyzing information advancements and international relationships assists investors recognize just how gold costs fluctuate.Supply and Demand Dynamics

Supply and need greatly affect gold costs. Gold mining and manufacturing impact supply degrees. Mining obstacles or constraints decrease supply which causes enhanced gold costs. Gold demand originates from its usage in jewelry creation, technical applications and investment functions. When need increases gold prices increase and when demand lowers gold prices drop. Gold demand experiences short-term rises throughout festivals and wedding celebration seasons in countries that eat considerable amounts of gold. Understanding these market dynamics gives the ability to visualize possible shifts in gold costs.

Analyzing Gold Market Data

Charts make it possible for analysis of gold market data by displaying both rate activities and trading volumes which explain market task. These tools assist you make informed decisions.

Interpreting Gold Cost Charts

Evaluation of gold cost graphes shows the pattern of gold prices as they evolve via time. The offered chart types for assessing gold costs consist of line charts, bar graphes, and candle holder charts. Line charts represent patterns in an easy method however candlestick charts provide even more thorough details because they show open, high, reduced and close prices. While assessing these charts look for patterns like uptrends which indicate possible ongoing cost rises and sags which indicate prospective rate reductions. Assistance and resistance levels identify rate points that stop rate movements or trigger them to change direction and consequently influence get or offer decisions.Moving averages are an additional valuable tool. Cost data smoothing develops a unified moving line that aids recognize trends. Temporary investors generally make use of short relocating averages and long-lasting investors make use of longer moving standards.

Understanding Gold Trading Volumes

The trading quantity of gold suggests the overall amount of gold that transforms hands during a certain amount of time. Market trends acquire verification from durations with high volume that accompany solid market movements. When rates rise alongside high trading quantity it suggests robust buying task. Rate charts present trading quantities via bar representations underneath. When trading quantity reaches high levels it reveals enhanced financier passion while reduced volume suggests investors may doubt or unenthusiastic. Quantity assists traders discover breakouts when rates prolong beyond typical trading boundaries. A breakout come with by significant quantity indicates an authentic change in market sentiment as opposed to simply a quick increase in costs. Checking trading volume helps you comprehend gold market characteristics and supports informed trading decisions.Gold Trading Strategies

Numerous techniques exist that enable investors to make informed choices throughout gold trading. Researching technical evaluation alongside essential evaluation brings about much deeper understanding of market trends and economic impacts.Technical Evaluation Techniques

Technical analysis requires the exam of rate charts and market data to anticipate future market behavior. Candle holder patterns offer a device for investors to identify potential reversals or continuations in the cost fads of gold. Relocating averages enable investors to discover market trends by minimizing the influence of price volatility. The loved one toughness index (RSI) aids find when markets reach extreme overbought or oversold levels which commonly show a possible turnaround in rate instructions. Support and resistance degrees function as important markers for traders when setting their entrance and leave factors. Technical evaluation exposes potential pattern changes through chart formations such as head and shoulders. Using several indicators together supplies traders with a thorough perspective. Mastering these methods calls for both practice and monitoring.Fundamental Analysis Approaches

Fundamental analysis takes a look at different economic elements which influence gold pricing. It is important to keep track of economic indicators such as interest rates and inflation While high-interest prices can lower gold's appeal due to the fact that it does not pay interest, rising inflation usually boosts gold demand as individuals view it as a protective financial investment.Another factor is geopolitical stability The condition of gold as a safe-haven financial investment causes its costs to climb throughout durations of stress and dispute. Capitalists must check currency strength with specific interest to the united state buck due to the fact that gold rates generally move in the contrary instructions of USD strength.