Is Gold a Secure Investment for New Investors?: A Look at Financial Safety

Gold presents itself as a wise investment choice for newbies. Individuals frequently view gold as a safe financial investment option when compared to various other kinds of financial investments. Individuals have relied upon gold to secure their wide range for hundreds of years. Individuals see gold as a safe haven possession because its value continues to be stable during market instability. Gold's historic efficiency shows its capacity to maintain stability during times of financial chaos. You ought to research both benefits and downsides prior to you acquire gold. Recognizing gold's efficiency throughout numerous market atmospheres enables you to select your investments better. Gold serves as a possession with specific attributes that define its role in economic markets.

Gold is a prominent financial investment choice. Gold preserves its condition as a result of both its historical significance and its physical characteristics. By comprehending these aspects you will much better appreciate gold's value as an asset.

Historical Relevance of Gold

For centuries gold has kept its standing as a beneficial asset. For countless years ancient people valued gold both as currency and attractive fashion jewelry. Individuals have always discovered gold unique due to the fact that it combines rareness with remarkable elegance. During financial slumps individuals buy gold. Gold preserves its worth during monetary downturns when various investments encounter depreciation. Since gold keeps its dependability even during financial downturns it becomes recognized as a safe haven property.You can see gold's importance today, as well. Governments hold gold in reserves. Governments keep gold books to support national currencies and make sure financial security.

Physical Properties and Storage

Gold incorporates high thickness with malleability and remarkable resistance to rust. This makes it a durable financial investment. The distinct coloration and shiny appearance identify gold from other steels.When purchasing gold, storage is essential. Gold can be maintained your home or kept in a safe-deposit box or with the services of a specialist custodian. Every storage method for gold involves distinct expenses and prospective dangers. While home storage space uses ease it needs required protection measures. Financial institution storage space offers a secure and simple solution yet in some cases needs payment of charges. Professional storage space delivers first-class security however includes a high cost.

Market Characteristics of Gold Investment

Gold investment is affected by a number of elements. Supply and need determine gold's rate while volatility and liquidity influence acquiring and marketing ease. Finding out about these components allows capitalists to make informed choices.

Supply and Need Factors

Gold supply depends on removal from mines along with recycled material and sales made by reserve banks. A diminished mining output restricts gold supply which usually activates cost increases. The fields that drive demand for gold include precious jewelry making, technological applications and financial investment functions. Rising need from these fields generally causes increased gold costs. The state of the global economic situation influences both supply and demand levels. During durations of unpredictability financiers usually turn to gold which subsequently raises both demand and price. The interest in gold reduces during periods of financial security which leads to a decline in its demand.Central financial institutions also play a role. Their market actions involve buying or selling considerable quantities of gold that affect market conditions. Getting expertise of these market elements will certainly assist you make even more informed decisions in trading.

Price Volatility and Liquidity

Gold's price volatility can impact your investments. Sharp cost swings generally take place because of political occasions incorporated with money variations and global dilemmas. The measure of Liquidity shows how rapid gold can be bought or offered without transforming its market value. Physical gold properties such as bars and coins often tend to experience reduced liquidity when compared to gold-backed safeties. ETFs and similar noted gold safety and securities provide boosted liquidity which helps with quicker transaction times. Gold preserves its online reputation as a stable investment yet its rate remains prone to quick market shifts. Evaluating both volatility and liquidity allows you to integrate your gold investments with your economic objectives and run the risk of limit.

Gold's Function in Portfolio Diversification

Incorporating gold right into your financial investment profile aids decrease danger while giving increased security. Gold differs from various other possession groups which includes significant value to your financial investment portfolio by enhancing equilibrium.Correlation with Various other Possession Classes

Gold demonstrates marginal relationship with both stocks and bonds in investment behavior. Gold keeps its pattern when stock exchange decrease instead of following them. Gold has a tendency to maintain its worth and can increase in price throughout periods of market decrease. Including gold to your portfolio helps shield you from monetary losses in various other investment locations. Financiers worth gold because historic information reveals that it does well throughout periods of economic uncertainty. Capitalists frequently select gold as a financial investment choice throughout inflationary periods or money declines because it keeps its buying power. Finding out about these patterns enables you to make use of gold for market security throughout unpredictable times.Risk Reduction Benefits

Adding gold to your financial investment profile serves to reduce its overall danger. The independent nature of gold from stocks and bonds helps reduce investment return volatility. Incorporating gold right into your investment technique causes less unforeseen losses when financial conditions intensify. Gold works as a reliable safety action versus inflation which makes it a crucial part for financial investment portfolios. As rising cost of living boosts the acquiring power of paper money decreases yet gold continually retains its worth. Gold aids safeguard your monetary properties by maintaining their value throughout time. Gold investments enhance your profile's durability. The asset serves as a securing layer that minimizes market volatility results on your complete investment performance. Beginners who intend to attach stability discover this risk decrease extremely valuable.Investment Automobiles for Gold Exposure

Exploring gold investment involves different methods. Each option uses different benefits and threats. Pick the investment approach that ideal satisfies your certain requirements and purposes.

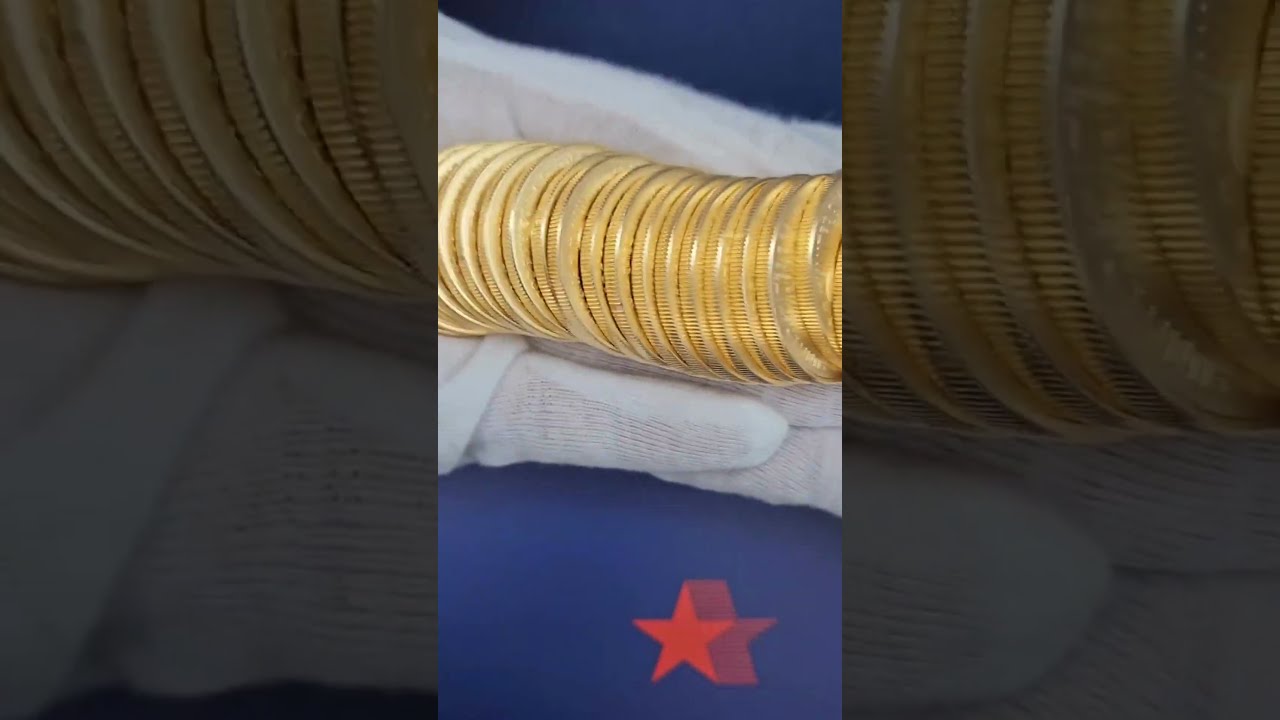

Physical Gold: Bars and Coins

Physical gold investment involves purchasing real things such as gold bars and coins. Via this technique you obtain real possession of a physical possession with safe and secure storage space choices. The tangible nature of holding physical gold gives capitalists with peace of mind while including security to investment profiles.However, possessing physical gold needs secure storage. Safe storage space options for physical gold include either renting a risk-free down payment box or establishing a home safe. The purchase and sale of physical gold might sustain additional costs such as dealership markups and delivery expenditures. Assess these variables before selecting to invest in physical gold.

Gold ETFs and Shared Funds

Capitalists can gain direct exposure to gold with Exchange-Traded Finances (ETFs) and shared funds as opposed to holding real gold pieces. Financiers can track gold rates because these funds behave like stock financial investments. The cost changes of gold allow you to obtain monetary benefits without the requirement to keep physical storage space. Financiers can buy and sell ETFs easily on stock market which gives them with versatile financial investment options. A manager directs investments in gold-related possessions for mutual fund savers. This investment technique expenses much less than acquiring physical gold while permitting you to trade through your brokerage firm account.Gold Mining Supplies and Bonds

When you acquire gold mining supplies you get ownership in companies that remove and produce gold. Your financial returns from this investment depend both on the market rate of gold and how well the business carries out. You can attain considerable returns if the company carries out effectively.Gold bonds can also provide direct exposure. Companies and federal governments issue bonds that pay interest with their value linked to gold prices. Gold supplies present possible profit chances however tend to show higher volatility. Their value shows considerable variation according to market problems which demands careful examination. Research firms completely before picking this investment course.

Risks and Considerations for Beginners

Several essential factors should be examined when buying gold. Some individuals may locate it unanticipated that gold rates experience significant modifications. Possession of gold includes several expenditure types you must recognize.Understanding Market Fluctuations

Gold rates can fluctuate swiftly. A number of aspects including supply-demand dynamics and international events in addition to financial variations influence gold rates. Gold looks like a secure financial investment alternative yet it brings its very own collection of threats. Monitoring market movements and remaining upgraded with worldwide occasions is necessary for educated choice making. This will assist you make better selections. The marketplace's unpredictability calls for preparedness for both favorable and unfavorable modifications. Developing a plan enhances your ability to control these uncertain variables.

Assessing Complete Prices of Ownership

Buying gold needs taking into consideration prices beyond the rate per ounce. Besides the cost of gold you need to cover extra expenditures for storage space services and insurance protection as well as trading fees. Ownership of physical gold coins or bars usually incurs added costs for secure storage in a secure deposit box. Financial investment defense versus burglary or loss needs insurance coverage. You'll face additional charges when you trade gold. Financiers need to take into consideration all linked expenditures before dedicating to gold financial investments. Recognizing these extra prices allows you to determine whether gold is suitable for your financial plan and investment method.Strategies for Investing in Gold

The option of gold investment method requires making a decision between long-lasting and short-term techniques. Considering the uncertain changes of gold rates is necessary when examining the functionality of market timing.

Long-Term vs Temporary Investment

Buying gold for a long period works as an investment safety net. You invest in gold for an extended duration while anticipating its value to increase. Buying gold for the long-lasting carries less danger since gold generally preserves its value gradually. The focus of this technique focuses on stability over rapid revenue generation. Temporary investment requires buying gold and offering it rapidly. Your approach aims to acquire revenues by benefiting from fast cost changes. The approach needs consistent surveillance of market movements and involves higher risk levels. Quick profits are possible with this method however you additionally run the risk of losses.Timing the Market: Is It Feasible?

Even professionals find timing the gold market difficult. Gold prices can experience speedy adjustments due to different impacts such as worldwide occasions and currency variations. Identifying the optimum time to purchase or market shows difficult.Instead, think about a dollar-cost averaging method. With this strategy you make repaired financial investments at routine durations regardless of what the rate is. This technique prevents you from buying every little thing when rates go to their top.

There's also technological evaluation. Past price patterns work as a basis for forecasting future market movements. While useful, it's not constantly accurate. Staying notified and utilizing danger monitoring tools must be a top priority.