How do self-directed precious metals IRAs operate?

To shield your retirement funds you may want to think about establishing a Precious Metal IRA. This financial investment automobile allows you keep gold, silver, platinum, and palladium in your retirement account which supplies an unique defense against rising cost of living and market volatility. Comprehending the benefits of Rare-earth element IRAs needs learning more about their working and the process to establish one. Make certain to review essential standards to pick a reliable custodian that will certainly manage your investment. Integrating precious metals into your investment portfolio will enhance your economic security as you move on. A Rare-earth element individual retirement account serves as a special Individual Retired life Account (INDIVIDUAL RETIREMENT ACCOUNT) planned for holding physical precious metals like silver and gold. This type of account allows you expand your retirement savings options while adhering to internal revenue service policies. Choosing a gold IRA or silver IRA provides tax obligation benefits and possession protection which supports your lasting retirement planning purposes. Consisting of precious metals in your financial investment portfolio permits both wealth preservation and lasting growth which aid secure your financial future and achieve your retired life goals. Maximizing your investment approach requires staying updated on both custodial duties and market fads. Payments to this individual retirement account function similarly to those made to typical pension which supply tax-deferred development advantages for your financial investments. Efficient wealth administration and retirement tax preparation require understanding of IRS contribution limitations and potential charges for non-compliance. Buying precious metals aids secure your profile from market swings while functioning as a protect versus rising cost of living. The IRS governing structure is necessary due to the fact that it establishes acceptable steel kinds and needs custodians and depositories to follow established requirements. Via this tactical decision your portfolio will certainly take advantage of improved diversity in addition to enhanced risk management capacities. Buying Rare-earth element IRAs supplies essential advantages for capitalists. Rare-earth element Individual retirement accounts provide several advantages that include safeguards versus rising cost of living and monetary market fluctuations. Precious metals like silver and gold keep their worth throughout economic crises which establishes them as vital components of diversified investment portfolios. An economic expert can analyze the marketplace and customize your financial investment plan to meet both your retirement purposes and your threat preferences.

Protection Against Inflation and Market Volatility

Gold and silver stand apart as trusted security versus rising cost of living and market variations that makes them sound investments for those that aim to expand their properties gradually. When financial conditions end up being unstable precious metals experience market value hikes which shield retirement savings acquiring power and increase monetary safety and security. The volatile state of stock markets has driven many financiers to seek defense through precious metals which caused major boosts in both need and value against the backdrop of global political tensions and financial chaos.Tax Advantages and Portfolio Diversification

A Rare-earth element IRA offers essential tax benefits while enhancing profile diversification that with each other support effective wide range management and long-lasting financial planning. This technique functions as an element of an overarching financial investment strategy which uses the special qualities of precious metals to construct wealth and secure economic security over expanded periods. The ability to postpone taxes plays a vital role in retired life tax obligation planning by helping to handle riches circulation efficiently and maintaining cash flow throughout retirement distributions.How Rare-earth element Individual retirement accounts Work

Precious Metal Individual retirement accounts function as self-directed investment alternatives that enable you to save physical properties like silver and gold within pension while remaining compliant with IRS policies concerning steel storage space and account facility. These accounts supply numerous financial investment possibilities via rare-earth element ETFs and bullion which sustain comprehensive retired life planning and lasting financial investment methods. Property safety calls for correct evaluation of custodians via their expert expertise, storage solutions and compliance with industry regulations. Recognizing both custodial charges and fiduciary responsibility will substantially influence your investment monitoring method. With the critical positioning with competent retirement you can improve tax obligation benefits while making the most of market cycles to reach financial stability and maximize your retired life circulation approach.Types of Precious Metals Allowed in IRAs

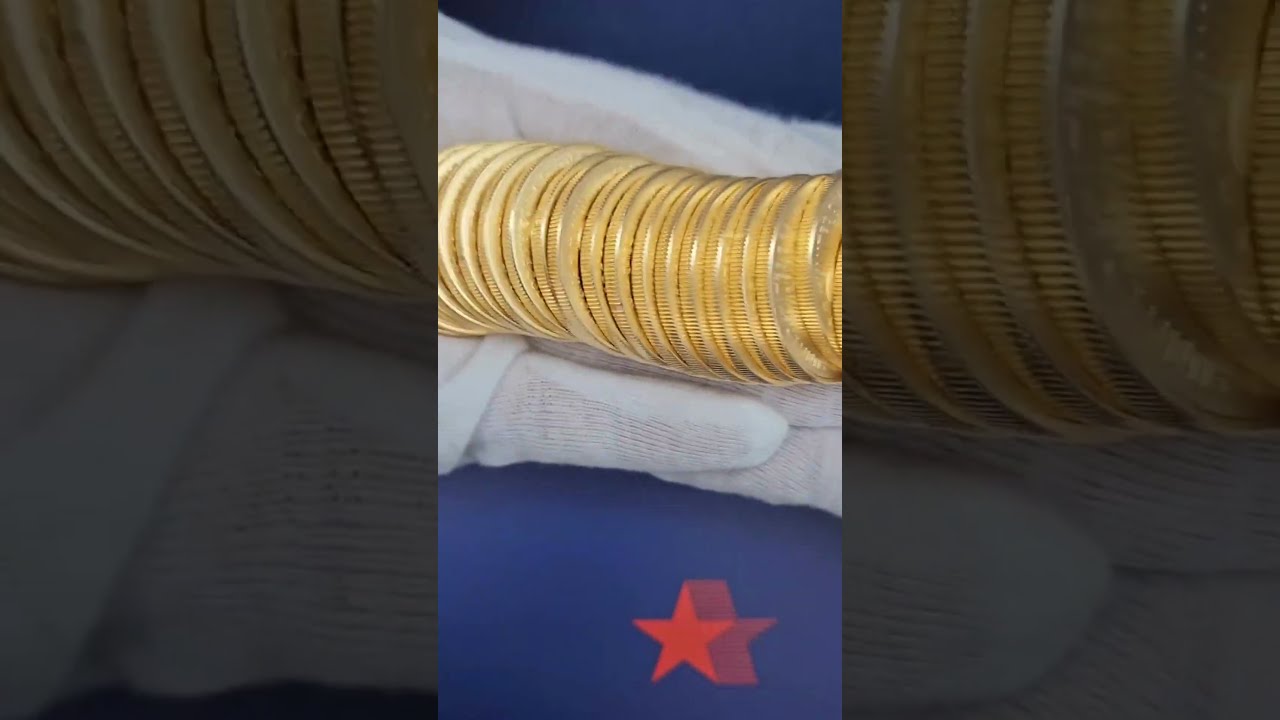

Precious Metal Individual retirement accounts require investors to comply with IRS regulations for choosing bullion, coins and physical possessions to make sure eligibility for tax obligation advantages. Investors who intend to create a strong retirement portfolio require to recognize these requirements to correctly make use of physical property advantages. Platinum and palladium need their own certain criteria to guarantee that only premium top quality steels qualify. Conduct extensive due persistance when selecting properties to see to it they meet IRS requirements and originate from relied on suppliers to avoid complications in your retired life technique. Establishing a Precious Metal individual retirement account needs following particular steps to make certain correct arrangement. To develop a Rare-earth element individual retirement account you must finish multiple essential steps that consist of choosing a reliable custodian and implementing a rollover from existing retirement accounts while maintaining governing conformity. Once your account has been set up you can begin a rollover or contribution to spend your retirement savings in gold and silver in addition to other accepted precious metals. You require to thoroughly examine their fees while assessing their credibility and solution alternatives. The documents process requires you to provide individual information and define your financial investment objectives. Comprehending tax effects and IRS regulative conformity prevents potential fines. Support for choosing the very best custodian for your Rare-earth element Individual Retirement Account. Choosing the ideal custodian for your Precious Metal individual retirement account is important to safeguard and manage your investments effectively. Trustworthy custodians provide clear cost structures together with trustworthy storage space options for precious metals in both bullion and coin types. Recognize essential considerations and prospective warning signs when selecting a custodian. Picking the right custodian for your Rare-earth element IRA needs careful analysis of numerous aspects and cautious recognition of warning signs that may impact your investment's safety and security and development potential. The primary elements to evaluate consist of the custodian's reputation in the sector and cost transparency along with their market expertise in precious metals and their capability to supply strong retirement withdrawal techniques and financial investment education and learning. One must completely comprehend the cost framework due to the fact that unrevealed costs could lower your investment returns. You have to carry out thorough due diligence before making a commitment to guarantee the safety and security of your financial investment.How do rare-earth element individual retirement account work?

A self-directed IRA known as a rare-earth element IRA allows individuals invest in tangible precious metals like silver and gold to expand their retirement savings. Typical IRAs usually permit financial investment only in supplies, bonds, and mutual funds. What advantages come with investing in a precious metal Person Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT)? A precious metal individual retirement account offers several advantages consisting of profile diversity and inflation protection while functioning as a safeguard during economic downturns. Precious metals show a consistent track record of protecting their value with time which develops them as dependable financial investments for long-term holding periods. Which precious metals are eligible for investment through a rare-earth element individual retirement account? A precious metal IRA permits you to buy physical gold, silver, platinum, or palladium. Investments can be made in coins together with bars and numerous other bullion styles. The IRS imposes thorough laws worrying the pureness degrees and permitted types of steels within a rare-earth element individual retirement account. What steps must I follow to develop a precious metal individual retirement account? You have to companion with a custodian who has know-how in self-directed Individual retirement accounts to develop a precious metal IRA. Your custodian will certainly assist you in developing your account and guide you via acquiring and storing your precious metals. Potential financiers need to find a trusted custodian with experience in precious metal IRAs for their retirement planning. Is it possible to move cash from an existing IRA into a rare-earth element IRA account? It is possible to relocate money from your standard individual retirement account or Roth IRA and also a 401(k) strategy into a precious metals individual retirement account. A rollover is the technique utilized to transfer funds from an existing IRA right into a rare-earth element IRA and it have to be completed within 2 months to avoid charges. A monetary expert and the custodian ought to be gotten in touch with to correctly carry out the funds transfer procedure. What storage methods can be utilized for precious metals within an IRA? A precious metal individual retirement account can be saved with numerous choices such as an off-site vault facility, a safe-deposit box at a bank, or within a home storage space IRA. Before picking a home storage space IRA you require to totally recognize the stringent internal revenue service policies controling this choice.