Navigating the Gold Rush: Why Rising Gold Pricing Make Today the Best Day for a Gold IRA

Introduction

As the planet continues to explore financial uncertainties and political tensions, one asset class has consistently drawn focus: gold. The beauty of gold has captivated owners for millennia, not only as a symbol of success but also as a dependable hedge against inflation and industry fluctuation. With current developments indicating that gold charges are rising , several are left wondering: Is now the time to start a Gold IRA?

In this extensive essay, we likely probe into the workings of investing in gold Accounts, mainly during intervals of rising gold charges. We’ll discover the advantages of gold Reits, how they work, their duty relevance, and why investing in gold was been important for your monetary coming. Getting ready to embark on an enlightening trip through the world of gold investment!

Gold Prices Are Rising: Is Now the Time to Start a Gold IRA?

Becoming Gold as an Investment

Gold has long been regarded as a secure shelter for owners. Throughout background, it's been used not just as forex but also as a store of value. When areas fluctuate or when economy weaken, gold typically shines brightest.

The Historical Value of Gold

Generally, gold has maintained its value stronger than most other supplies during times of financial problems. For illustration:

- During the 2008 economical turmoil, while investment businesses plummeted, gold pricing surged.

- In times of high inflation rates, traders sheep to gold, driving up its cost.

This factual perspective is crucial for understanding why rising charges does imply that now is the excellent occasion for a Gold IRA.

The Dynamics Behind Rising Gold Prices

Economic Factors Influencing Gold Prices

Several factors contribute to swings in gold prices :

By understanding these interactions, you can make informed choices regarding your expenditures.

Why Select a Gold IRA?

What is a Gold IRA?

A Gold Individual Retirement Account ( IRA ) allows you to invest in physical gold while enjoying tax advantages associated with traditional retirement accounts.

Forms of Precious Metals Allowed in a Gold IRA

While largely focused on gold, Accounts can also include :

- Silver

- Platinum

- Palladium

This expansion is farther improve your investment plan.

Gains of Investing in a Gold IRA

Navigating the Gold Rush: Why Rising Gold Pricing Make Nowadays the Ideal Occasion for a Gold IRA

The existing environment presents exclusive possibilities for investing in a Gold IRA. With rates trending upward, probable returns become extremely appealing. But what accurately makes this instant therefore appropriate?

Timing Your Investment: Analyzing Current Trends

Rising rates indicate increased demand—often driven by ambiguity in various industry.

Current Market Analysis

- As of October 2023, experts predict continued rise in important copper norms.

- Investor attitude tends to move towards safeness during stormy periods.

Long-Term vs Short-Term Investment Strategies

When considering entering the market :

How to Open and Fund Your Gold IRA

Step-by-Step Guide to Setting Up Your Gold IRA

Choosing an IRS-Approved Custodian

It's essential to conduct rigorous research before selecting your steward; certainly all caretakers handle precious metals evenly properly.

Investment Options within a Gold IRA

Varieties of Precious Metals You Can Invest In

Owners may regard diverse aspects of precious metals :

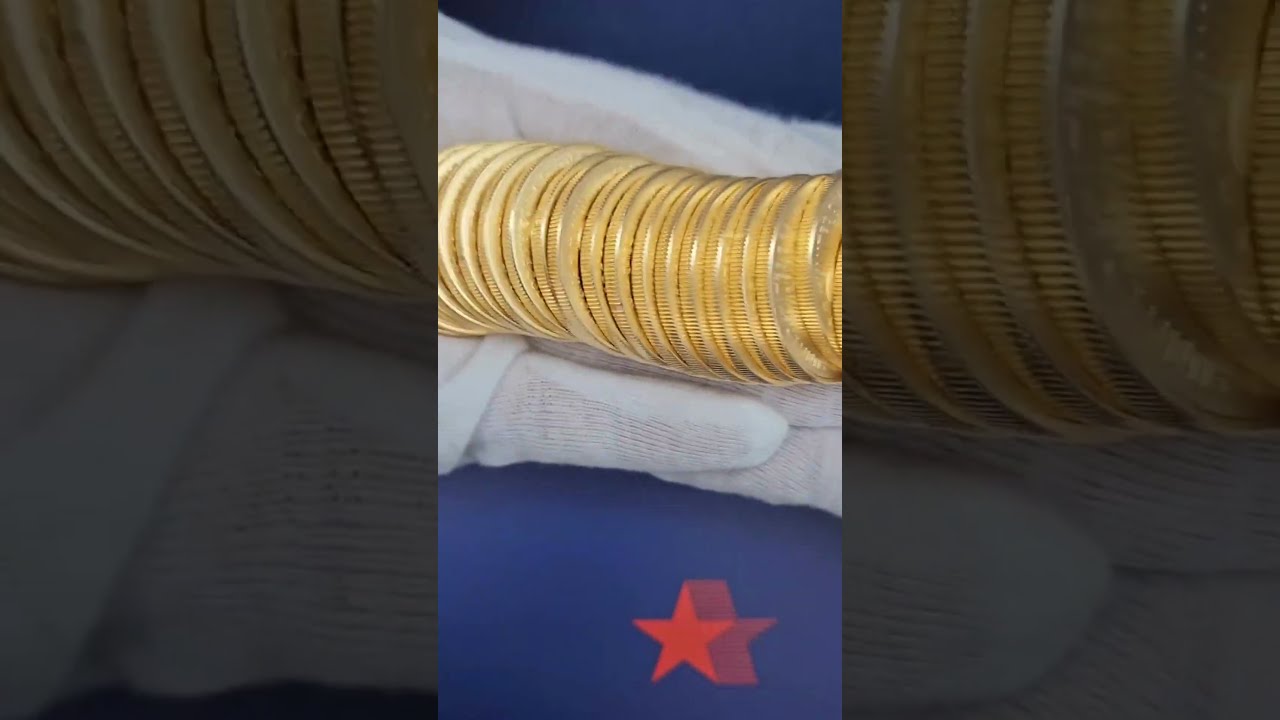

- Currencies( electronic. g. , American Eagles )

- Bars

- Rounds

Quantitative Analysis: Coins vs Bars

| Type | Pros | Cons | |-------------|-----------------------------------|----------------------------| | Coins | Easier profitability; collectable benefit| Possible higher premium| | Bars | Lower rates per gram | Less distinctive|

FAQs

1. What are the tax implications of a Gold IRA?

Gold IRAs offer comparable taxes gains as conventional Accounts; nevertheless, dispersion may be taxed at common salary charges upon drawback.

2. Does I maintain different precious metals in my Gold IRA?

Yes! Besides gold, silver, platinum, and platinum are acceptable within your profile.

3. How do I pick between currencies and cafes?

Consider cash demands and specific interests; cash does give better sale prospects due to their delivery.

4. Are there any threats associated with investing in a Gold IRA?

Like any investment, there are dangers involved including sector oscillations and backup charges which may alter general earnings.

5. What happens if I want to buy my real gold?

You can buy it back through your caretaker or discover personal buyers; nonetheless, ensure that you follow IRS recommendations regarding trades within your bill.

6. How much should I spend in my Gold IRA?

Your investment really fit with your entire resume method; generally recommended not exceeding 10%-15 % into alternative assets like precious metals.

Conclusion

Navigating today’s fluctuating financial landscape requires strategic thinking and informed decision-making—particularly when it comes to investments like those found in a gold-backed Individual Retirement Account ( IRA ). With rising prices indicating powerful future effectiveness ability coupled with factual endurance against financial upheaval, there's never been a more powerful time than now to consider investing in this iconic asset class.

If you're asking yourself whether "gold prices are rising: is now the time to start a Gold IRA? ", remember that acting promptly can benefit both your portfolio's stability and growth potential significantly over time.

In conclusion, it ’s evident that navigating this modern-day'gold rush ' could yield fruitful results if approached thoughtfully and strategically!