What is the process by which does a self-directed precious metals IRA work?

A Precious Metals individual retirement account represents an eye-catching financial investment selection for those intending to diversify their retired life portfolio with non-traditional possessions. This specific account type enables you to store actual precious metals like gold and silver together with platinum and palladium as part of your financial investment profile that includes conventional possessions such as stocks and bonds. This discussion will assist you through the operational auto mechanics of Precious Metals IRAs and detail which metals qualify and what the payment ceilings are while examining both the advantages and threats of using this financial investment technique. Both skilled investors and beginners will certainly acquire the ability to make enlightened financial choices via recognizing these aspects. Any person who intends to broaden their retirement with alternative financial investments have to comprehend Precious Metals Individual retirement accounts. A Precious Metals individual retirement account gives the ability to add physical precious metals like gold, silver, platinum, and palladium to your retirement funds which delivers security versus market instability and rising cost of living through profile diversification. This investment method uses possible tax benefits that makes it an attractive choice for securing wide range and protecting capital gains. This area clarifies what Precious Metals IRAs are and their particular feature. A Precious Metals IRA functions as a self-directed retirement account which permits financiers to include physical precious metals such as silver and gold bullion and coins alongside various other IRS-approved steels in their financial investment profile. Tangible assets in your portfolio act as defense for your riches versus inflation and financial instability. Retirement savings gain security with their intrinsic value which remains secure throughout financial market changes.

How a Precious Metals IRA Works

A Precious Metals IRA operates according to a details collection of treatments that comply with IRS policies. Investors can add precious metals to their retirement profiles with this system while benefiting from safe and secure storage space services and required custodial solutions.Eligible Steels, IRS Laws, and Contribution Limits

A Precious Metals IRA accepts gold, silver, platinum, and palladium offered they meet the purity needs set by IRS rules. The IRS defines that people under half a century old may contribute a maximum of $6,500 to pension in 2023 while those half a century or older take advantage of a catch-up arrangement that elevates their restriction to $7,500.Investment Choices and Fees

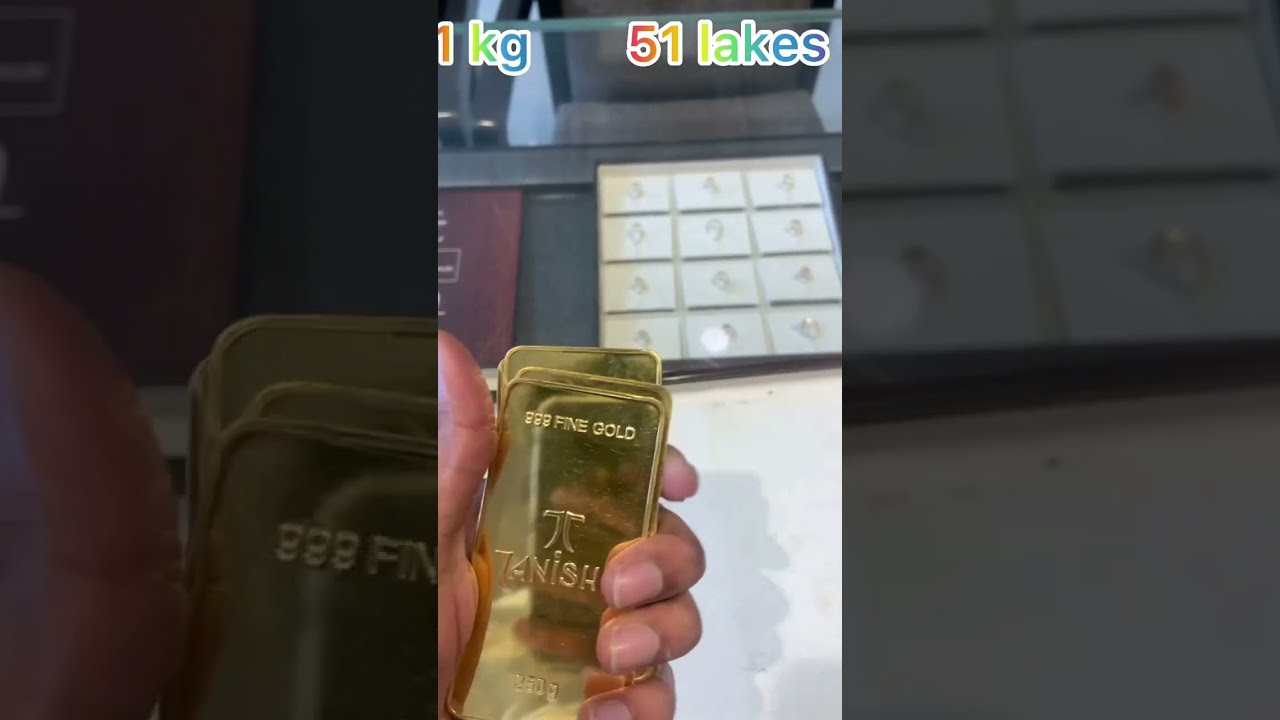

Precious Metals individual retirement account investment options consist of bullion and coins as well as added physical rare-earth element forms. Custodial service charge represent a vital factor to consider since they affect your overall financial investment returns. A thorough understanding of financial elements is important because they directly influence investment returns and can significantly influence the performance of a Precious Metals Individual Retirement Account. Precious Metals Individual Retirement Account Investments Have Both Advantages and Drawbacks A Precious Metals IRA provides investors with profile diversity benefits and risk factors and functions as a possible rising cost of living protection versus market volatility.Potential for Development and Diversification

Purchasing a Precious Metals IRA gives significant diversity capacity given that these metals function as a stabilizing force within your investment profile throughout times of economic instability. When these metals enter into your investment technique you acquire the advantage of their inherent worth while also developing defense against rising cost of living and currency instability. The twin feature of precious metals as both safety possessions and investment chances makes them important for attaining long-lasting financial safety.Risks and Factors to consider for Investors

A Precious Metals individual retirement account supplies significant benefits however needs mindful examination of threats and factors to consider especially in terms of market volatility and funding preservation effect. Retired life circulations include tax obligation effects that have the prospective to reduce your web returns considerably. You must do an extensive danger assessment prior to you buy this option.How does a precious metals individual retirement account work?

A precious metals IRA serves as a self-directed retired life fund that lets capitalists store substantial precious metals like gold and silver within their retired life profiles. Investing in precious metals provides capitalists with choices to expand their financial investment profiles while maintaining wealth stability. What benefits does a precious metals individual retirement account provide for capitalists? A precious metals IRA offers profile diversification along with a bush against rising cost of living and market variations. Precious metals have actually continually maintained their worth in time which develops them as trustworthy retirement assets. Is it feasible to transfer funds from an existing individual retirement account right into a precious metals IRA? Funds from typical Individual retirement accounts, Roth IRAs or 401(k)s can be moved right into a precious metals individual retirement account. The rollover process allows you protect your retirement funds' tax obligation benefits while adding physical assets to your profile for prospective tax-deferred development. What actions should I take to add precious metals to my individual retirement account? You have the choice to get precious metals either via a reputable individual retirement account custodian or by collaborating with a precious metals supplier. Choosing a reliable and skilled business to handle your gold and silver coin investments assures that your precious metals please established purity standards. What rare-earth element limitations relate to my individual retirement account financial investments? The internal revenue service supplies comprehensive guidelines pertaining to allowable precious metals for IRAs that include restrictions on collectible coins and needed metal pureness standards. To keep your individual retirement account's tax advantages energetic and manage your retirement portfolio properties correctly you ought to comply with custodian advice and preserve conformity with relevant guidelines. Is it possible to physically get my precious metals from a precious metals individual retirement account? While you are allowed to physically obtain precious metals in your IRA account, such activity counts as a distribution and sets off potential taxes and fines. Protected and insured depositories with your custodian ought to hold your precious metals to preserve your individual retirement account's tax-advantaged condition and meet pension conformity requirements.