Can I Hold Gold and Silver in My IRA?

The mixture of Person Retirement life Accounts (Individual retirement accounts) as well as precious metals like gold and silver has actually come to be a center of attention for financiers that strive to secure their retired life cost savings as well as build potential monetary security. The short article will clarify individual retirement account functions along with define which precious metals agree with for transforming your financial investment profile and securing possessions. Branching out along with precious metals uses numerous conveniences including protection from rising cost of living and also boosted asset distribution while improving your portfolio's potential to endure market variations. Our support covers the whole entire method of obtaining these bodily properties coming from setting up a self-directed IRA to storing administration and also comprehending tax obligation implications for maximizing asset market value development. Discover how precious metals come to be important parts within your retired life method. Any person wanting to create different investments as well as allocate resources for retirement savings needs to have to recognize the connection in between IRAs (Person Retirement Life Accounts) and precious metals for monetary protection. Learn about Individual Retirement life Funds and also discover their operational technicians. The Retirement Plan or even individual retirement account functions as a retirement cost savings automobile which supplies tax obligation perks to strengthen your financial investment technique. An IRA allows your investments to grow tax-deferred so you spend taxes only when you take funds coming from your account during retired life. This attribute allows IRAs to serve as crucial tools for long-lasting financial investment planning. Standard Individual retirement accounts allow pre-tax payments which produce an instant tax obligation deduction yet require tax of drawbacks as usual revenue during the course of retirement life. It is essential to know the specific guidelines for additions and withdrawals for these profiles given that they all have certain guidelines regarding annual limits and also IRS conformity requirements.

Types of Precious Metals Allowed in IRAs

Your investment technique will certainly profit greatly from comprehending which metals the internal revenue service enables for IRAs due to the fact that they determine diversity and also liquidity within your collection. Following conformity rules is actually essential to completely take advantage of income tax advantages as well as achieve the greatest individual retirement account growth eventually. Bodily metallics are actually necessary for collection variation since they shield entrepreneurs from rising cost of living as well as market instability.Relied on dealerships assist you comply with governing requirements while guarding your assets and also being sure your metal investments fulfill IRS requirements and sustain your monetary method. Acquiring precious metals by means of an IRA aids attain economic defense and also profile diversity. An IRA that includes precious metals delivers many benefits because these metallics work as both a rising cost of living bush and a means to diversify your expenditure portfolio through commodity investing and also economic recession protection.

Hedge Versus Inflation and Diversify Your Portfolio

Purchasing precious metals by means of an individual retirement account supplies clients along with three main conveniences including security against inflation while enabling tax deferred development and portfolio diversification to obtain long-lasting monetary growth. Throughout record precious metals like gold and silver have kept their market value in uncertain economic conditions by operating as safe houses during monetary distress and also delivering a risk monitoring approach for entrepreneurs. Investors now value the requirement for liquid expenditures including metal ETFs and gold certifications that allow easy sale during time periods of unpredictability while sustaining wide range management methods. Actions to Acquisition Precious Metals in an IRA The initial steps to buy precious metals in an individual retirement account consist of establishing a self-directed IRA for alternate asset assets and becoming aware of expenditure selections that line up with retirement objectives.Opening an individual retirement account and also Investing In Valuable Metals

Investing in precious metals via an IRA asks for a systematic process that begins with opting for the best manager as well as features understanding your assets approach including asset circulation alongside tax advantages and also take the chance of control. After establishing your account you'll be able to get metals entitled for Individual retirement accounts like gold and silver gold or coins which comply with internal revenue service requirements. Following your choice of a self-directed IRA custodian you have to then fill out the required documents to develop your account. Remain informed concerning the storing possibilities that managers deliver to meet internal revenue service standards and also shield your financial investment tactic coming from assets danger. Constant adherence to these operations will definitely enhance your financial investment portfolio while maintaining observance along with internal revenue service criteria as well as maximizing your wide range development tactic.Storage and Tax obligation Considerations

To optimize your Precious Metals IRA financial investment performance while remaining up to date with IRS regulations, you need to have to understand storage space demands and tax implications. These variables affect tax-deferred growth and also long-lasting investment potential.

Investors should save precious metals in IRS-approved protected centers. While this may lead to added storage expenses, it offers vital protection for the expenditure portfolio's market value and also security.

Secure storing of metallics by means of managers in accredited vaults affects both your financial investment technique as well as prospective returns. Recognizing storage space charges is actually important to reviewing exactly how they influence your expenditure's internet increase or even loss. Too much fees can reduce possible revenues over time.

An IRA provides the possibility to buy precious metals, including each physical possessions and also gold and silver trading choices. Precious metals rate amongst the best preferred individual retirement account holdings given that they give reliability, growth ability, and also help for retirement riches and also legacy planning.

Which precious metals are actually qualified for purchase within an IRA account?

IRA profiles allow the acquisition of precious metals such as gold, silver, platinum eagle, and palladium. These metals supply several benefits for dealing with rising cost of living and financial crises.

What restrictions exist when purchasing precious metals for an IRA?

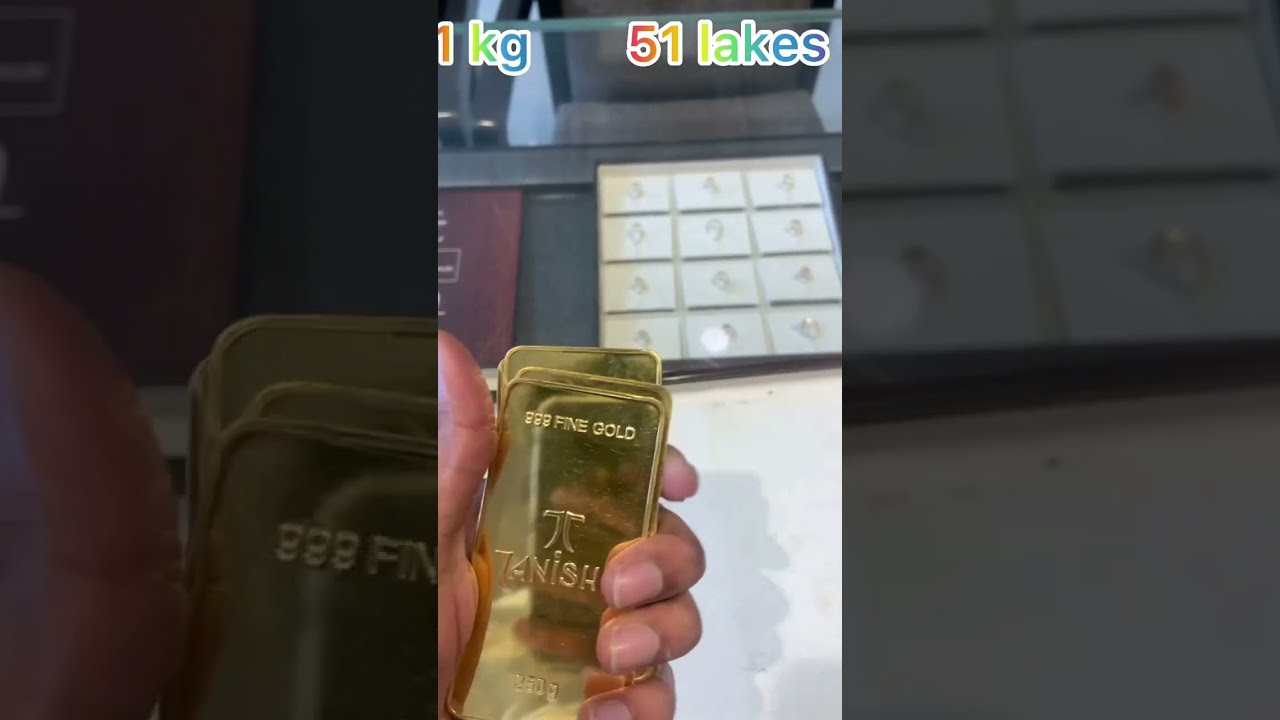

Investors face limitations on the certain precious metals they can easily buy within an IRA. Investments are limited to specific types, including bullion pieces, gold clubs, and also silver spheres. The IRS restricts collectible coins, fashion jewelry, and numismatic pieces in IRAs to preserve regulative compliance.

Can capitalists purchase precious metals in an IRA utilizing pre-tax or post-tax money?

Investors may acquire precious metals through an individual retirement account using either pre-tax or even post-tax funds. Payments to Conventional IRAs use pre-tax bucks, while Roth individual retirement account payments entail post-tax bucks. This difference impacts the tax benefits accessible throughout the expenditure period.

What benefits carries out acquiring precious metals by means of an individual retirement account give to investors?

Precious metals like silver and gold held in an IRA expand retirement profiles and also allow long-term growth capacity. They additionally preserve riches as well as safeguard against rising cost of living. This allows capitalists to keep bodily possessions like gold and coins in their retirement life accounts.

What threats exist when obtaining precious metals for an IRA?

Investing in precious metals via an IRA comes with inherent risks. Market value variations may influence expenditure performance, as well as fees for buying, storing, and also guaranteeing metallics have to be considered.

Understanding internal revenue service rules and also potential tax advantages or obligations is essential before making financial investment choices. Entrepreneurs should analyze these dangers and also look for guidance coming from a monetary specialist accustomed to gold and silver investing, tutelary companies, and also alternate investments.