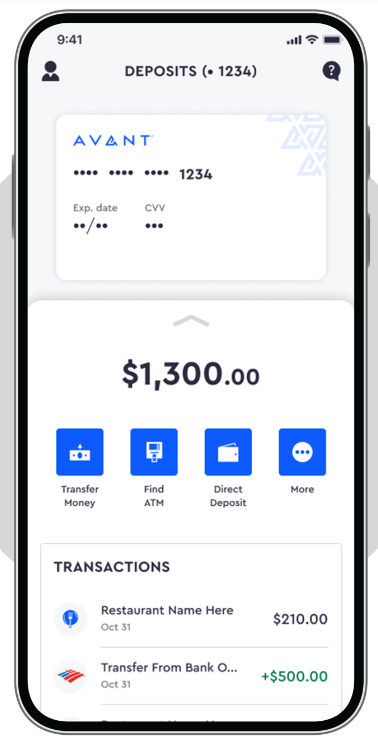

what is avant credit card

In this Avant credit card review, we will review whether this card is a excellent suitable for those with a limited credit history. Although the AvantCard does not impact your credit report when you apply, it is an unsecured item that does have a small credit limit The Avant Personal Loan 2022, on the other hand, does not call for a credit rating whatsoever. The consumer evaluations and also comparison chart below should be helpful for those who are taking into consideration requesting this personal loan.

The Avant credit card is a strong choice for a credit-building person with reasonable to ordinary credit. The annual fee is cost effective and also the credit limit is a respectable beginning factor. The Avant card also permits you to prequalify without a hard pull on your credit history. As long as you more than the age of eighteen, this kind of credit card is an excellent alternative for establishing a solid credit history. The Avant credit card review additionally highlights the advantages and also disadvantages of this credit card.