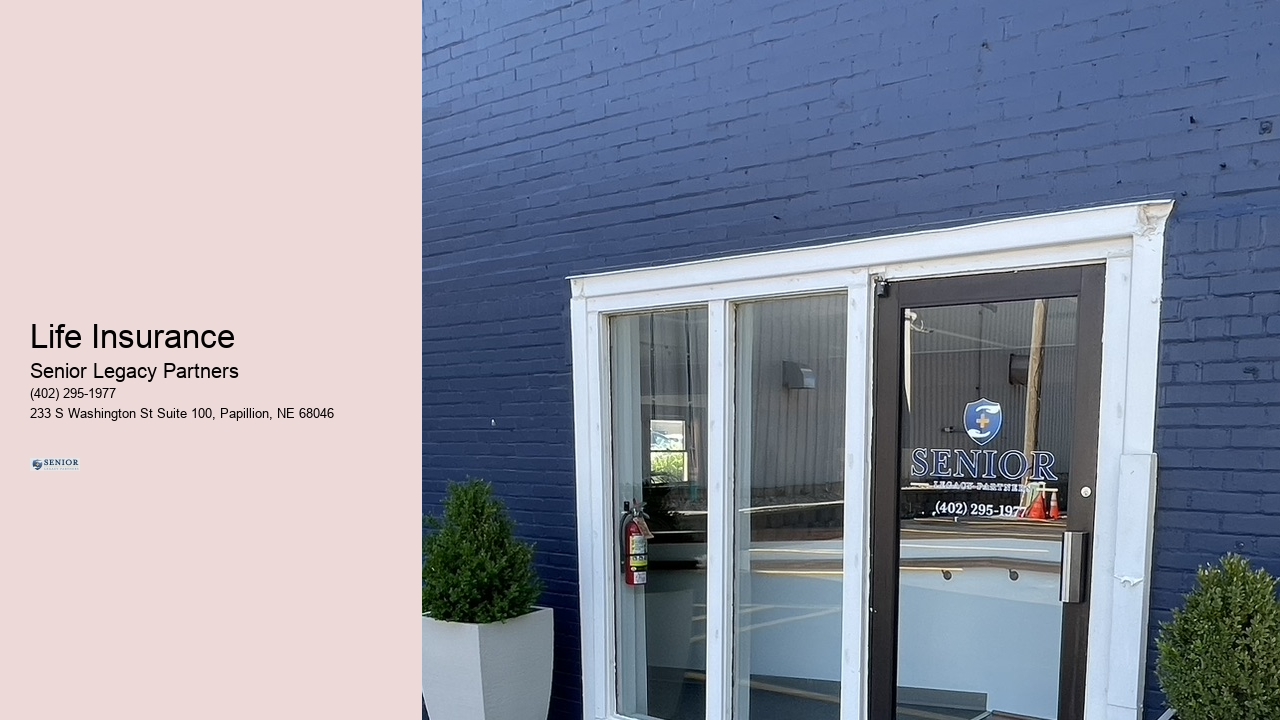

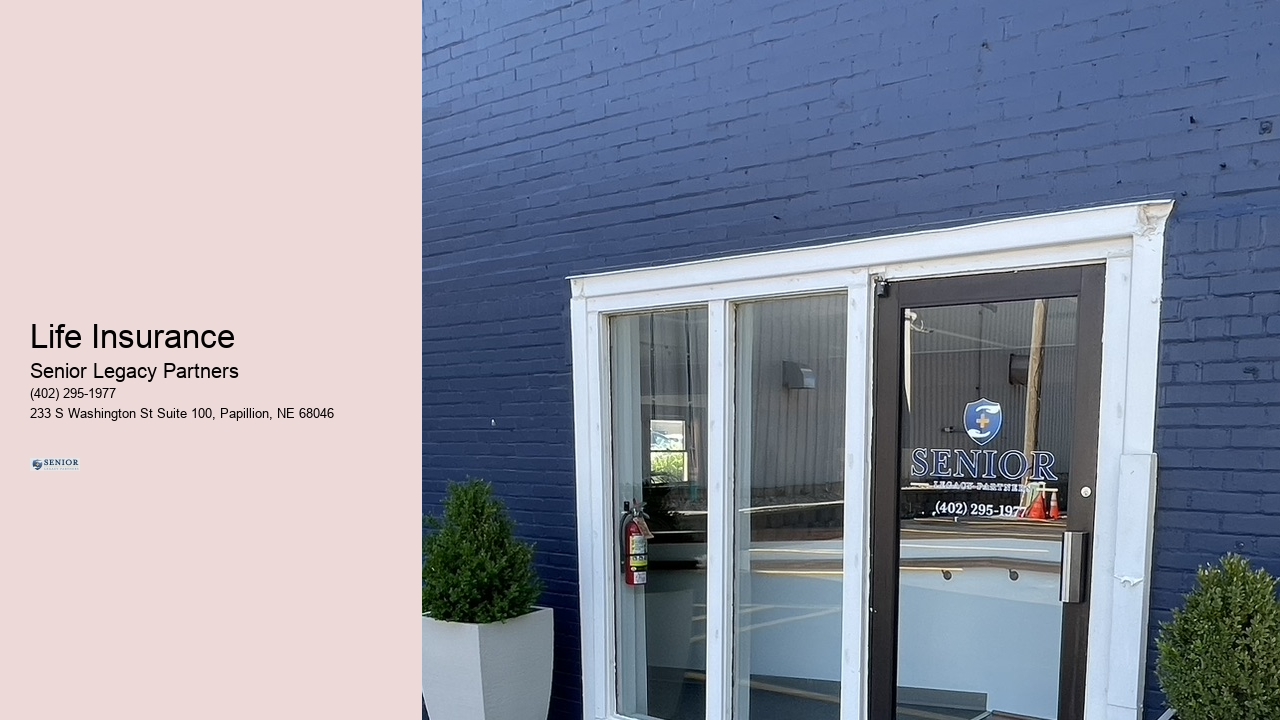

At Senior Legacy Partners, our goal is to enable you to face retirement with total confidence. As an independent brokerage, we focus on the most important retirement concerns—healthcare, long-term care, and legacy preservation. Specializing in Medicare Supplement, Medicare Advantage, long-term care coverage, annuities, and life insurance, we provide expert guidance in these critical areas. Our partnerships with the leading carriers give us the freedom to tailor plans specifically for you—whether it’s enhancing your Medicare, securing your long-term care, or protecting your legacy with the right annuity or life insurance—so your legacy remains protected, your way.

trusted Medicare and life insurance broker.

View Insurance Broker Papillon Nebraska in a full screen map

Service areas: Papillon Nebraska, La Vista Nebraska, Ralston Nebraska, Omaha Nebraska, Council Bluffs Iowa, Glennwood Iowa, Lincoln Nebraska, Sarpy County Nebraska, Cass County Nebraska, Pottawatomie County Iowa, Mills County Iowa, Fremont County Iowa, Page County Iowa

| Insurance Broker Benefits | |

|---|---|

| Keyword | Description |

| Compare Insurance Quotes | Brokers compare multiple carriers to find affordable rates. |

| Tailored Insurance Plans | Customized coverage designed around specific client needs. |

| Policy Renewal Assistance | Support in reviewing and renewing existing insurance policies. |

| Claims Assistance | Helps clients file claims quickly and get faster settlements. |

| Affordable Insurance Options | Brokers identify cost-effective plans for families and businesses. |

| Trusted Insurance Guidance | Professional advice to simplify choosing the right coverage. |

Understanding Medicare can be overwhelming, especially when it comes to choosing the right Medicare Advantage plan that fits your healthcare needs and budget. For seniors in Papillion, finding the best Medicare Advantage options is crucial to ensuring comprehensive coverage while maximizing savings. This detailed roadmap will guide you through the complexities of Medicare Advantage plans available in Papillion, offering insights, tips, and local expertise to help you make informed decisions with confidence.

Medicare Advantage plans, also known as Medicare Part C, are an alternative to Original Medicare (Parts A and B) that are offered by private insurance companies approved by Medicare. These plans combine hospital, medical, and often prescription drug coverage into one plan. Many Medicare Advantage plans in Papillion provide additional benefits beyond Original Medicare, such as dental, vision, hearing, and wellness programs.

Key types of Medicare Advantage plans include:

Medicare Advantage plans have grown in popularity among seniors in Papillion because they go beyond traditional Medicare benefits. Here are some significant advantages:

Choosing the right Medicare Advantage plan doesn’t have to be confusing. Follow these steps to find the most suitable option in Papillion for your healthcare needs and budget:

Seniors in Papillion benefit from Medicare Advantage plans designed to meet the needs of our community. Local providers understand the healthcare landscape, offering plans with:

Leveraging these local advantages empowers seniors to select Medicare Advantage plans that truly cater to their lifestyle and health requirements.

“Switching to a Medicare Advantage plan tailored for Papillion helped me save over $50 monthly on premiums, plus I received coverage for my new hearing aids. The local network let me keep my family doctor, and I appreciate the transportation benefits for my medical visits.”

“I was confused about Medicare options until I talked to a licensed agent familiar with Papillion. The plan I chose included prescription drug coverage and dental, which Original Medicare didn’t cover. I feel secure knowing my healthcare is coordinated and affordable.”

“Thanks to the comprehensive wellness programs in my Medicare Advantage plan, I’ve improved my fitness and overall health. The local emphasis on preventive care makes a noticeable difference.”

Original Medicare (Parts A & B) provides hospital and medical coverage but does not include prescription drugs or extra benefits. Medicare Advantage plans combine these benefits and often offer additional services like dental and vision through private insurance companies.

It depends on the plan type. HMO plans require you to use network providers, while PPO plans offer more flexibility. Check if your doctors participate in your chosen plan's network.

Costs vary by plan but typically include monthly premiums (some $0), deductibles, and copays. Many plans also have an annual out-of-pocket maximum that protects you from high expenses.

Enrollment periods include the Initial Enrollment Period, the Annual Enrollment Period (Oct 15 - Dec 7), and Special Enrollment Periods triggered by qualifying events like moving or losing other coverage.

Most Medicare Advantage plans include Part D drug coverage, but it’s essential to verify your specific medications are on the approved list (formulary).

Choosing the right Medicare Advantage plan in Papillion is a vital step toward protecting your health and finances as a senior. By understanding your options, evaluating costs, and leveraging local expertise, you can confidently select a plan that offers the coverage and savings you deserve.

Don’t navigate Medicare alone. Reach out to local Medicare specialists who know the ins and outs of Papillion healthcare plans. Whether you’re enrolling for the first time or looking to switch plans, professional guidance can simplify the process and ensure you make the best choice for your unique needs.

Contact us today for a free consultation and personalized Medicare Advantage plan comparison tailored for seniors in Papillion. Let’s embark on your roadmap to savings and comprehensive coverage together.

They offer health insurance plans that cover medical expenses, doctor visits, hospital stays, and other healthcare needs.

A Medicare insurance broker assists seniors and eligible individuals in selecting Medicare plans, including Part A, B, C (Medicare Advantage), and Part D.

Look for licensed professionals with good reviews, experience, and options that fit your specific coverage needs.