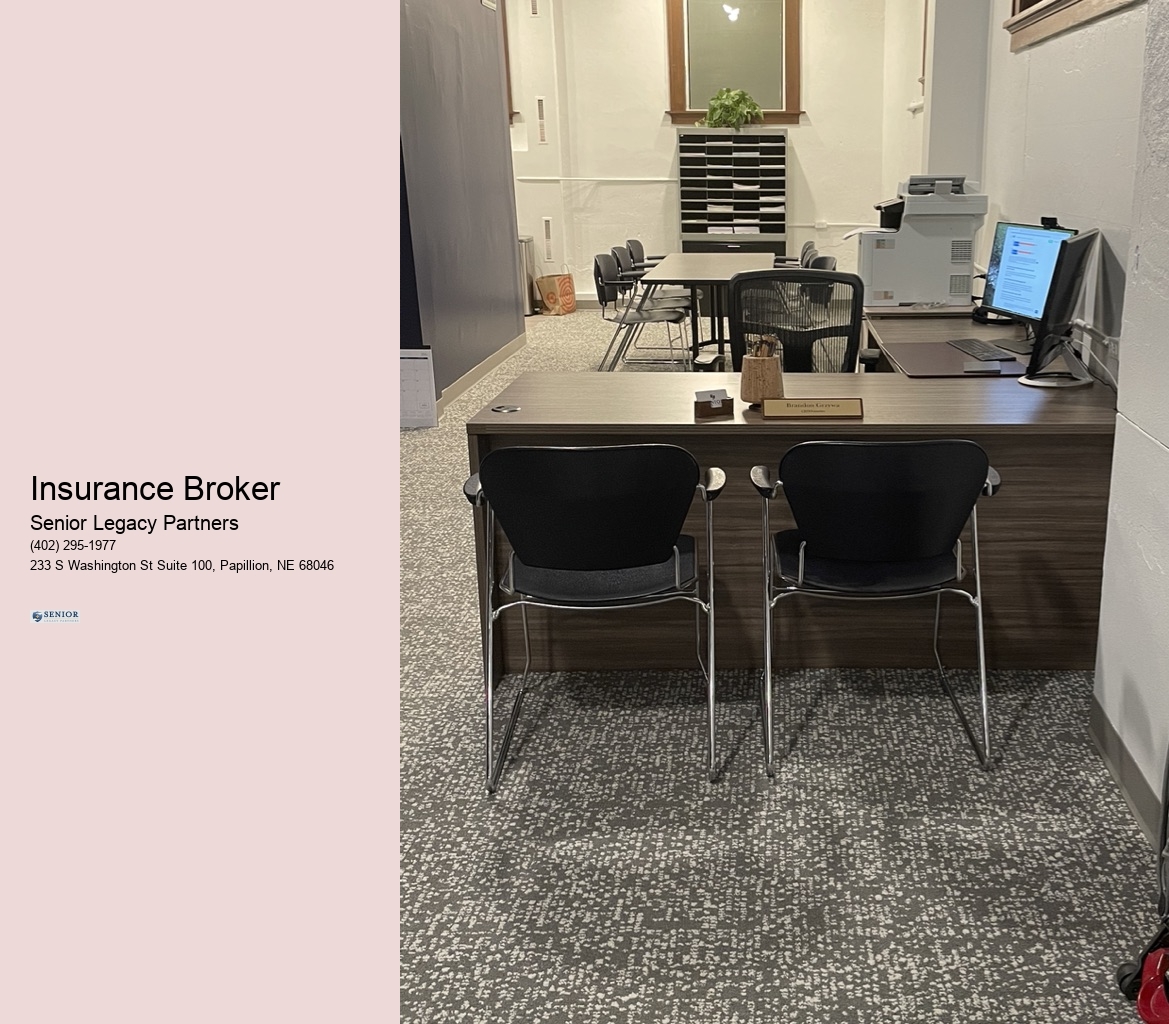

At Senior Legacy Partners, we empower you to navigate retirement with absolute confidence. As an independent brokerage, we tackle the biggest challenges in retirement, from healthcare and long-term care to securing your legacy. Specializing in Medicare Supplement, Medicare Advantage, long-term care coverage, annuities, and life insurance, we ensure that these crucial aspects of your retirement are handled with expertise. trusted Medicare and life insurance broker. Our partnerships with top carriers give us the freedom to tailor the perfect plan for your needs—whether it’s optimizing your Medicare coverage, securing long-term care, or protecting your legacy with the right annuity or life insurance—ensuring your legacy is protected, your way!

View Insurance Broker Papillon Nebraska in a full screen map

Service areas: Papillon Nebraska, La Vista Nebraska, Ralston Nebraska, Omaha Nebraska, Council Bluffs Iowa, Glennwood Iowa, Lincoln Nebraska, Sarpy County Nebraska, Cass County Nebraska, Pottawatomie County Iowa, Mills County Iowa, Fremont County Iowa, Page County Iowa

| Health & Medicare Plans | |

|---|---|

| Keyword | Description |

| Medicare Insurance Broker | Helps seniors compare Medicare Advantage and Supplement plans. |

| Medicare Advantage | Private plan option that provides all-in-one Medicare coverage. |

| Medicare Supplement | Additional policy that helps cover costs Original Medicare does not. |

| Medicare Part D | Prescription drug coverage plan for Medicare beneficiaries. |

| Medicaid Assistance | Insurance program for individuals with limited income or resources. |

| Medicare Enrollment Help | Guidance services for signing up and selecting Medicare coverage. |

As our population ages, the importance of long-term care insurance becomes increasingly evident. This financial protection helps families prepare for the costs associated with long-term care, making it essential to understand how much long-term care insurance costs in Papillion and the available options.

In Papillion, the average cost of long-term care insurance can vary significantly based on several factors, including your age, health status, and the type of coverage you choose. Typically, premiums might range from $100 to $300 per month for comprehensive coverage. Here are some crucial factors that impact pricing:

Long-term care insurance is a crucial investment for families in Papillion considering the rising costs of elderly care facilities and in-home care services. Here are some benefits:

Finding a policy that fits your budget doesn’t have to be a daunting task. Here are steps to help you identify affordable long-term care insurance:

Many residents of Papillion are concerned about securing long-term care insurance due to the rising costs associated with local nursing homes and assisted living facilities. On average, in Papillion, a month in a nursing home might set families back $8,000 to $12,000. This highlights the significant savings potential that long-term care insurance can provide.

For instance, one family in Papillion decided to invest in long-term care insurance when the patriarch turned 60. By securing a policy that covered home healthcare, they were able to save a substantial amount when he required assistance later in life. They attributed the financial relief it provided as a crucial factor in being able to care for him at home instead of moving him to a facility.

The average cost can vary, but generally it ranges between $100 to $300 per month, depending on various factors like age and health.

You can lower your premiums by opting for a higher deductible, starting your policy early, or choosing a policy that covers fewer services.

Yes, for many families, it provides essential financial protection and peace of mind against the high costs of care associated with aging.

Consider your specific care needs, review multiple policies, and consult with insurance professionals familiar with the local market.

Ready to explore your options for long-term care insurance in Papillion? Contact us today for a personalized consultation. Let us help you find the best and most affordable policy that fits your family's needs. Don't wait until it's too late—secure your peace of mind today!

Long-term care insurance helps pay for extended care services, such as nursing homes or in-home assistance, beyond regular health coverage.

Inquire about coverage details, premiums, deductibles, network restrictions, and any additional benefits.

An insurance agency is a business that employs agents or brokers to sell various insurance policies to individuals and businesses.