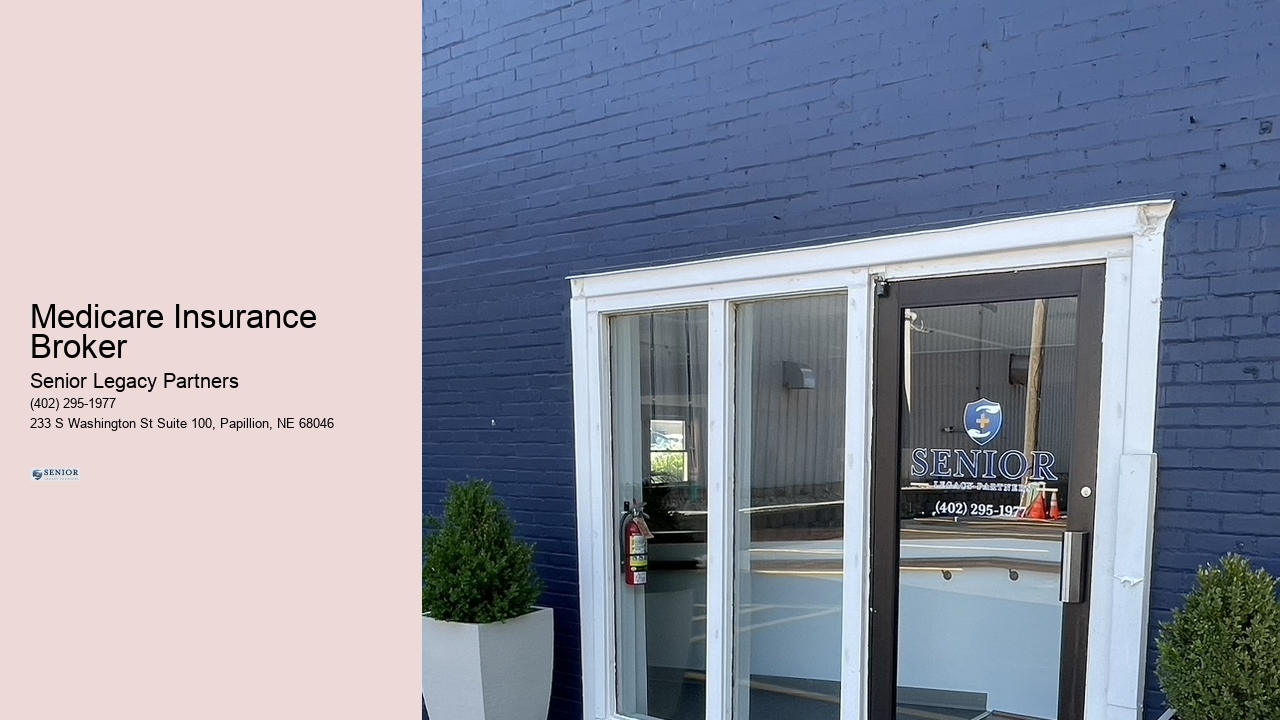

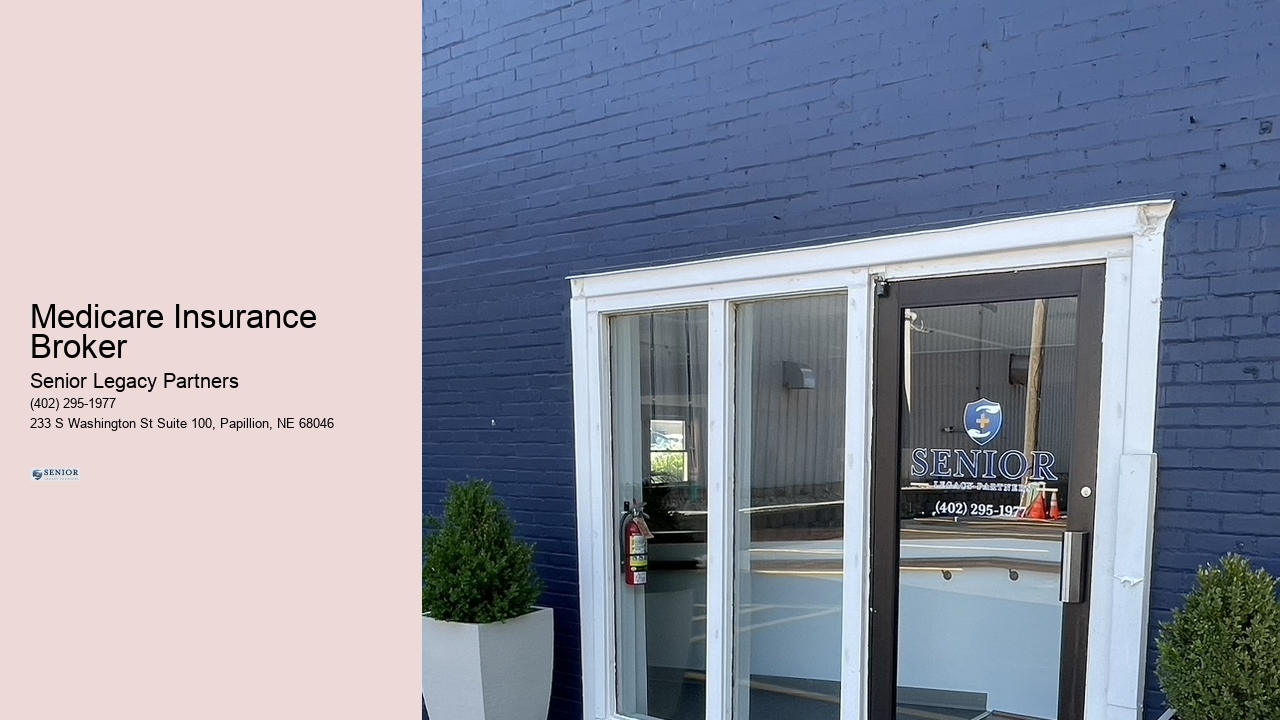

Senior Legacy Partners is committed to helping you navigate retirement with confidence. As an independent brokerage, we address major retirement challenges—from healthcare and long-term care to legacy protection—with expertise. We specialize in Medicare Supplement, Medicare Advantage, long-term care coverage, annuities, and life insurance, ensuring these essential components are expertly managed. Thanks to our partnerships with top carriers, we can design personalized plans—whether that’s optimizing your Medicare, securing long-term care, or safeguarding your legacy with suitable annuities or life insurance—making sure your legacy is protected your way!

trusted Medicare and life insurance broker.

View Insurance Broker Papillon Nebraska in a full screen map

Service areas: Papillon Nebraska, La Vista Nebraska, Ralston Nebraska, Omaha Nebraska, Council Bluffs Iowa, Glennwood Iowa, Lincoln Nebraska, Sarpy County Nebraska, Cass County Nebraska, Pottawatomie County Iowa, Mills County Iowa, Fremont County Iowa, Page County Iowa

| Property & Business Insurance | |

|---|---|

| Keyword | Description |

| Homeowners Insurance | Covers property damage, theft, and liability for homeowners. |

| Renters Insurance | Affordable coverage for personal belongings in rental housing. |

| Auto Insurance | Mandatory coverage for cars that protects against accidents and damage. |

| Business Insurance | Protects companies from liability, property damage, and employee risks. |

| Commercial Insurance | Specialized coverage for commercial property, liability, and business operations. |

| Liability Insurance | Protects individuals and businesses from legal claims and lawsuits. |

As health care costs continue to rise, understanding the intricacies of health coverage becomes essential for residents in Papillion. Among the various options available, combining Long-Term Care Insurance with Medicare presents a strategic approach to enhance your health coverage and secure your financial future. In this article, we will explore the benefits of this combination and how it can greatly impact your long-term health care plan.

Long-Term Care Insurance is designed to cover services that traditional Medicare does not. This includes assistance with daily activities such as bathing, dressing, eating, and even skilled nursing care. With the rising cost of healthcare, particularly in Papillion and its surrounding suburbs, it’s increasingly vital for locals to consider how this insurance works alongside their Medicare plan. Here are some compelling reasons:

Understanding how these two types of insurance work together is crucial. Medicare provides basic health care coverage but may not cater to long-term care needs. By adding Long-Term Care Insurance to your plan, you can:

In Papillion, the demographics indicate a growing number of seniors who can greatly benefit from this combination of insurance. Local healthcare facilities and providers are becoming increasingly aware of the critical need for dedicated long-term care services. By opting for Long-Term Care Insurance alongside Medicare, you equip yourself with a safety net in a community where personalized health care becomes a priority.

Consider the case of Margaret, a 72-year-old resident of Papillion. After undergoing hip surgery, she faced challenges with her daily activities due to a long recovery period. With Medicare alone, the postoperative care was limited, which left her struggling to maintain her independence. However, because she had combined her Long-Term Care Insurance with Medicare, she could access necessary rehabilitation services while enjoying peace of mind knowing that her expenses were covered. This allowed her not only to receive quality care but also to remain in her home as she recuperated.

Long-Term Care Insurance typically covers personal care services, home health aide services, nursing facilities, assisted living facilities, and sometimes adult day care services.

No, it is never too late to purchase Long-Term Care Insurance, although the younger you are when you purchase it, the lower the premiums will generally be.

Consult with a local insurance advisor who specializes in elder care planning to evaluate your options and find a policy that best fits your needs.

If you’re a resident of Papillion considering the benefits of combining Long-Term Care Insurance with Medicare, reach out to us today! Our team of dedicated professionals is ready to help you explore your options, tailor a plan that meets your unique needs, and secure your peace of mind for the future. Contact us now to schedule a consultation!

Use quotes from multiple providers, review policy terms carefully, and consult with an insurance professional.

Medigap policies are additional insurances that help cover out-of-pocket costs not included in Original Medicare.

Life insurance provides a financial benefit to beneficiaries when the insured person passes away, helping to support their loved ones.

An insurance broker is a licensed professional who sells insurance policies from multiple companies, helping clients find the best coverage for their needs.